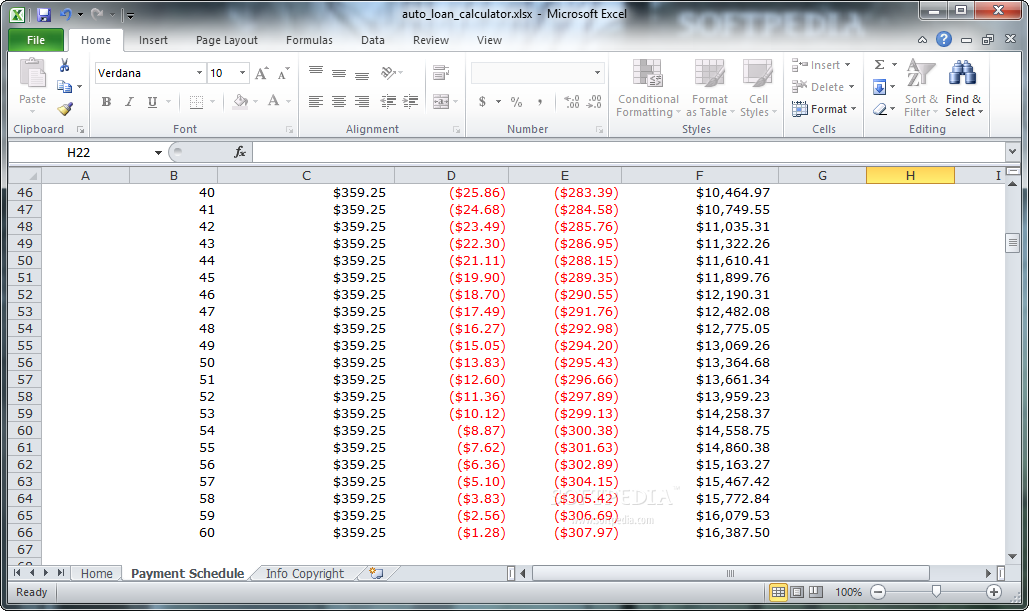

First of all, to calculate the balance of the loan, we will use the following formula in the cell H12:.First of all, you have to enter the original balance in cell H11.Let’s walk through the steps to calculate the balance of the loan. Step 4: Calculate Balance of Loan AmortizationĪfter completing the payment per month, the interest payment per month, and the principal payment per month, we are going to calculate the balance of the loan by using those values. Therefore, you will get the principal payment for twelve months of the loan as shown below.Next, drag the Fill Handle icon to fill out the rest of the cells in the column with the formula.As a result, you will get the principal for the first month as shown below.If you want to change this, you have to right-click on the cell, select format cells, and choose the subtype that you want. This is because it was selected as the default currency subtype for accounting purposes. This function will return the value in red with parentheses. Next, to calculate payment, we will use the following formula in the cell D8:.First of all, you have to type the data of annual interest rate, years, number of payments per year, and original balance as shown below.Let’s walk through the following steps to calculate the total payment of loan amortization. One can easily calculate one’s payment every week, month, or year by using this function. Then we will add this payment with an extra payment to get the total payment. Step 1: Calculate Total Payment of Loan Amortizationįirst of all, we are going to calculate the payment by utilizing the PMT function. Here is an overview of a car loan amortization schedule with extra payments in Excel. We use the Microsoft Office 365 version here, but you can utilize any other version according to your preference. We will use apply these financial functions to calculate the car loan amortization.

You should learn and apply all of these to improve your thinking capability and Excel knowledge. This section provides extensive details on this method. PMT stands for payment, IPMT is used to get the interest of payment, and PPMT is used to get the principal payment. Here, we will use PMT, IPMT, and PPMT financial formulas to create a car loan amortization schedule with extra payments. In the following section, we will use one effective and tricky method to create a car loan amortization schedule with extra payments in Excel, it is necessary to make a basic outline and calculations with formulas and calculate the final balance. Step-by-Step Procedure to Create Car Loan Amortization Schedule in Excel with Extra Payments Among the information found in the table is the number of years left to repay the loan, how much you owe, how much interest you are paying, and the initial amount owed. A Loan Amortization Schedule is a schedule showing the periods when payments are made toward the loan. Let’s say, the total value of the car is $200000.00, the annual interest rate is 10%, and you will pay the loan within 1 year. An amortizing bond, on the other hand, is one that repays a portion of the principal as well as the coupon payments. An amortizing loan is a loan where the principal is paid down throughout the life of the loan according to an amortization plan, often by equal payments, in banking and finance.

0 kommentar(er)

0 kommentar(er)